The MER – Is this new?

The Management Expense Ratio, or MER, is a fee charged on mutual funds for the costs associated with running the fund. It’s not a new fee. In fact, the MER has applied to mutual funds since they were introduced in the 1980s. Recent changes in mutual fund regulations, designed to ensure that investors are clear on the fees they are being charged, have brought the MER into focus. The MER now appears on all mutual fund statements, so investors can see what they’re paying.

How much do I pay?

The MER can range from about 0.5% to 4%, depending on the characteristics of the fund. Actively managed equity funds, for example, are more expensive to run than bond funds or passive investments like ETFs, but they have the potential to offer higher returns.

Where does the money go?

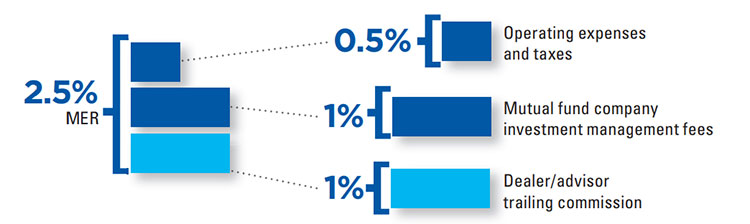

Looking at an example of a mutual fund with a 2.5% annual MER, you’ll see that the fee is allocated between two parties: the mutual fund company that manufactures the fund and the mutual fund dealer that distributes it. The dealer in turn compensates the advisor who recommended the fund.

Hypothetical example.

| Fee component | Mutual fund company |

|---|---|

| Operating expenses The cost of day-to-day management of the fund |

|

| Sales tax

Each fund must pay HST on the Management Fee and Operating Expenses of the fund |

|

| Fee component | Mutual fund company |

|---|---|

| Investment management fees

Pays for the professional managers involved in making effective investment decisions |

|

| Fee component | Dealer/advisor |

|---|---|

| Dealer services

The cost of managing and administering an advisory firm |

|

| Advisor services

The cost of providing financial advice to investors, plus the advisor’s cost of running their business. |

|

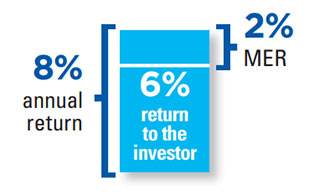

How do I pay for the MER?

The MER is calculated once a year based on the net assets of the fund. Fees are accrued daily and paid monthly. The investor does not pay the MER directly. The mutual fund company deducts the fees from the fund.

Hypothetical example.

How will I know what the MER is for my fund?

Your advisor can tell you everything you should know about MERs. Alternatively, MERs can be found on mutual fund company websites, the fund prospectus and Fund Facts sheets.

For more information, please contact your financial advisor.

For definitions of technical terms in this piece, please visit iaclarington.com/glossary and speak with your investment advisor.

The information provided should not be acted upon without obtaining legal, tax, and investment advice from a licensed professional. Commissions, trailing commissions, management fees, brokerage fees and expenses all may be associated with mutual fund investments, including investments in exchange-traded series of mutual funds. The information presented herein may not encompass all risks associated with mutual funds. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The iA Clarington Funds are managed by IA Clarington Investments Inc. iA Clarington and the iA Clarington logo, iA Wealth and the iA Wealth logo, and iA Global Asset Management and the iA Global Asset Management logo are trademarks of Industrial Alliance Insurance and Financial Services Inc. and are used under license.