iA Wealth Managed Portfolios

Expertly managed and built for diversification

With iA Wealth Managed Portfolios, you benefit from an all-in-one, actively managed solution that’s aligned to your goals and risk tolerance and backed by the deep investment expertise of some of the industry’s most highly regarded fund managers.

Built for your target-risk profile

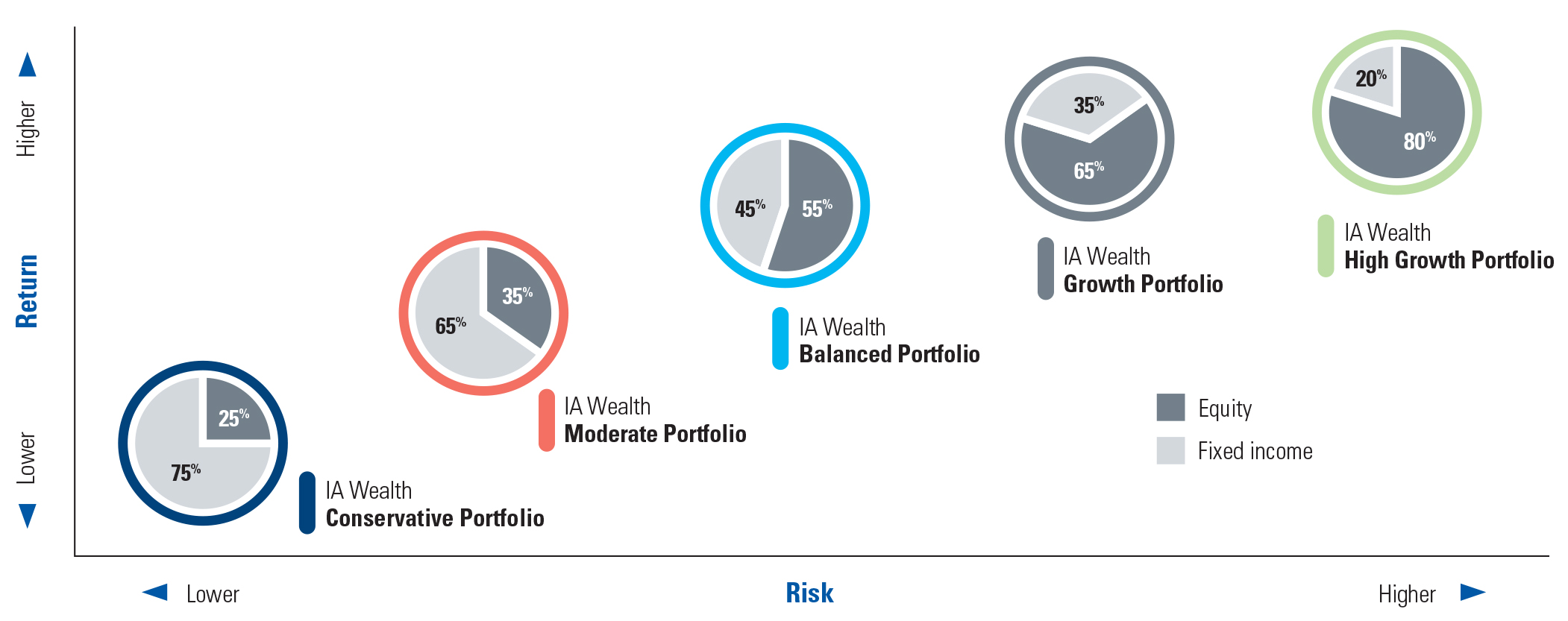

The five iA Wealth Managed Portfolios target the optimal balance of return and risk for a variety of investor types.

For illustrative purposes.

Optimized for complex markets

iA Wealth Managed Portfolios are actively managed and rigorously monitored to ensure they are optimally positioned for complex, evolving market conditions.

Active asset allocation

Strategically positions the portfolios for the long term, while retaining tactical flexibility to seize shorter-term opportunities and mitigate emerging risks.

Active foreign currency management

Seeks to enhance return potential and reduce volatility.

Active due diligence

Seeks to ensure that the underlying portfolio segments continue to deliver optimal performance.

Active rebalancing

Maintains each portfolio within its target-risk level.

Simple to set up. Easy to stay on track.

Simply complete the concise investor questionnaire with your advisor. It is designed to complement discussions you will have together to fully understand your unique investor profile. Once completed, it can help you and your advisor select the portfolio most suited to you.

Your portfolio is fully invested and diversified from the start, and remains invested and actively managed to help keep you on track towards your goals. If ever there are changes to your goals or financial situation, remember to inform your advisor to ensure that your plan is adjusted accordingly.

iA Wealth Managed Portfolios offer:

- Institutional approach to long-term wealth creation

- Choice across a range of five broadly-diversified, multi-asset portfolios

- All-in-one solution aligned to your investor profile

- Active management of security selection, tactical asset allocation and foreign currency exposure

- Daily portfolio monitoring with ongoing rebalancing to maintain designated target-risk levels

- In-depth reporting through quarterly commentaries, portfolio analytics and personalized annual statements

Disclaimer

Trademarks displayed herein that are not owned by Industrial Alliance Insurance and Financial Services Inc. are the property of and trademarked by the corresponding company and are used for illustrative purposes only. Fidelity Investments Canada is a registered trademark of 483A Bay Street Holdings LP. Used with permission. The PIMCO logo is used with permission from Pacific Investment Management Company LLC, www.PIMCO.com.