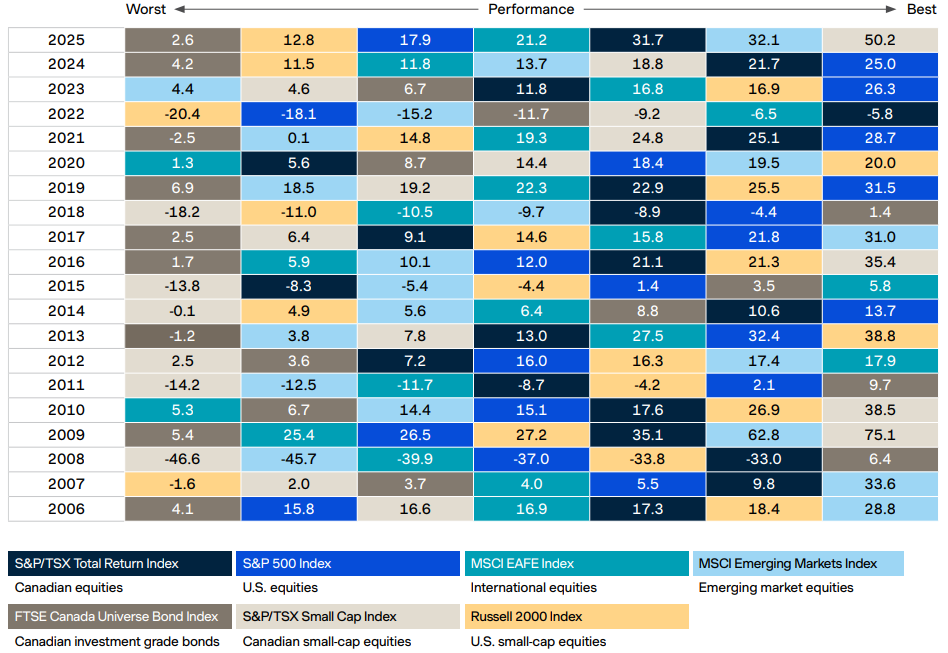

No asset class is the top performer all the time

You know the expression, ‘Never put all your eggs in one basket.’ Nowhere is this truer than in the world of investing. When the stock market is rising steadily, you may wish you had all your investments in equities. But the reality is that no asset class, whether it’s stocks or bonds, will always chart an upward path. The good news is that when one asset class isn’t doing so well, one of the others tends to step in with stable or positive performance, providing a smoother ride for the portfolio as a whole. This is the benefit of asset class diversification.

It’s important to diversify not just across asset classes, but also within asset classes. For example, a well-diversified portfolio will include stocks of both large and small companies. It’s also important to diversify across geographies. This means buying not just Canadian stocks and bonds, but also those from the U.S., Europe and emerging markets.

Source: Morningstar Direct. Returns in local currency unless otherwise specified, as at December 31, 2025.

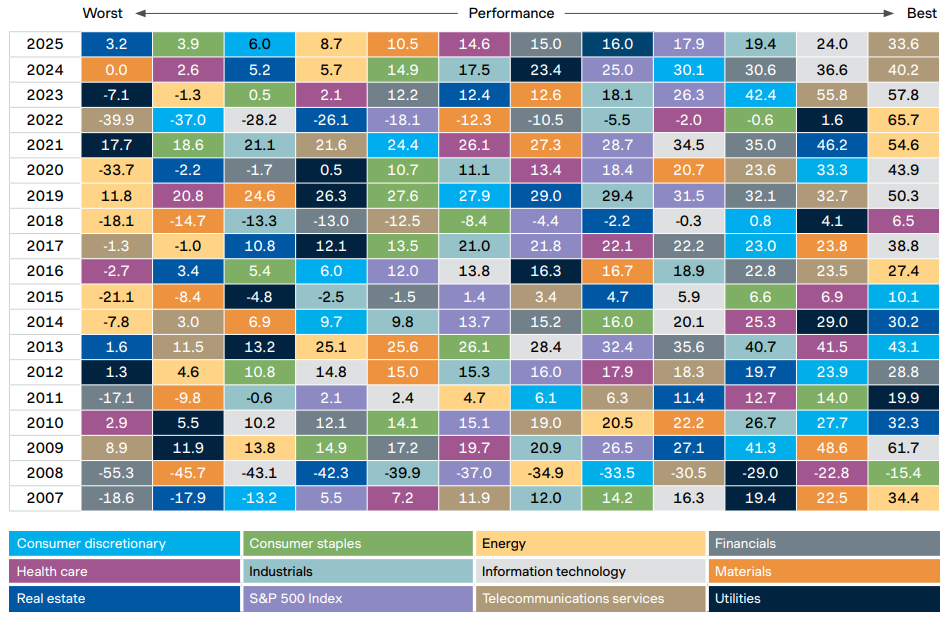

Sector diversification

Another critical step in building a properly diversified portfolio is ensuring that you have allocations to a wide variety of sectors and industries. Just as no single asset class will perform well all the time, no single sector will always deliver positive returns. Diversifying sector exposure gives the overall portfolio a better chance of participating in more of the market’s upswings while potentially reducing the negative impact of market downturns.

The chart shows calendar year returns for the sectors in the S&P 500 Index, representing equity performance in the largest market in the world.

Source: Bloomberg. Returns in local currency (USD), as at December 31, 2025.

Speak with your advisor to learn more about diversifying your portfolio.

For definitions of technical terms in this piece, please visit iaclarington.com/glossary and speak with your investment advisor.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. The information provided should not be acted upon without obtaining legal, tax, and investment advice from a licensed professional. Commissions, trailing commissions, management fees, brokerage fees and expenses all may be associated with mutual fund investments, including investments in exchange-traded series of mutual funds. The information presented herein may not encompass all risks associated with mutual funds. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The iA Clarington Funds are managed by IA Clarington Investments Inc. iA Clarington and the iA Clarington logo, iA Wealth and the iA Wealth logo, and iA Global Asset Management and the iA Global Asset Management logo are trademarks of Industrial Alliance Insurance and Financial Services Inc. and are used under license. iA Global Asset Management Inc. (iAGAM) is a subsidiary of Industrial Alliance Investment Management Inc. (iAIM).