Mutual funds are a popular investment option for helping Canadians achieve their financial goals. They are professionally managed, diversified investments that can provide ready access to your money.

As with any good or service you purchase, mutual funds have costs associated with them. It is important to understand what those costs are and how they will affect the return on your investment.

Costs of operating a mutual fund

There are a number of costs involved in running a mutual fund. It’s important to note that while many of the fees are charged to the fund and not directly to the investor, they do affect the return you will receive on your investment.

Mutual fund fees fall into three basic categories:

1. Management Expense Ratio (MER)

The Management Expense Ratio (MER) represents the expenses a fund company incurs for managing and operating a mutual fund throughout the year.

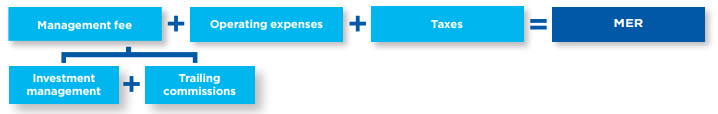

The MER has three main components:

Management fee

The management fee is generally the largest cost incurred by a mutual fund. It includes the salaries of the portfolio managers and their support teams, along with research costs and trailing commissions paid to an investment advisor and dealer for their ongoing services to an investor.

Operating expenses

Mutual funds pay an administration fee for the day-to-day expenses of operating a fund. Such expenses can include regulatory filing fees and other day-to-day expenses such as:

- Recordkeeping fees

- Accounting and fund valuation costs

- Custody, audit and legal fees

- Costs of preparing and distributing annual and semiannual reports and prospectuses

- Sales and marketing expenses

In certain circumstances, a fund may incur additional costs for Independent Review Committee (IRC) fees, portfolio transaction costs, interest and borrowing charges. These fees typically represent a very small portion of operating expenses.

Taxes

Mutual fund management fees and some operating fees charged to the fund are subject to Harmonized Sales Tax (HST). The HST rate is calculated based on the residency of fund unitholders, the value of their holdings and the HST rate in their province.

Anatomy of an MER

2. Trading Expense Ratio (TER)

The TER relates to the cost of trading activity within a given year. This includes brokerage fees, which are incurred when a fund manager buys or sells securities within a mutual fund. The TER also includes transaction fees, which are charged each time a security held by the fund is bought or sold.

If a fund has a TER of 0.25%, it means 0.25% of the fund’s average yearly assets went to trading expenses. Like the MER, the TER is charged directly to the fund and is deducted from its return.

The MER and TER are expressed as a percentage of a fund’s annual net assets and are deducted from a fund’s performance. Sales charges are paid directly by the investor.

3. Sales charges

Sales charges or “loads” may be incurred by an investor when buying or selling a mutual fund. Unlike MER and TER charges, sales charges compensate financial advisors for assisting clients with investment selection and providing ongoing services. There are two ways sales charges can be applied:

| Front-end load | Back-end load |

|---|---|

| A charge typically ranging from less than 1% to 5% is deducted from the investment amount and paid to the advisor’s firm upon the purchase of a fund. | No sales fee is charged to the investor at the time of purchase; instead, the mutual fund company pays the advisor’s firm a sales commission. An investor may incur a partial charge if they redeem their fund before a set period of time. |

Back-end loaded funds can be structured in two ways:

| Deferred sales charge | Low load |

|---|---|

| The sales charge to the investor is deferred for a set period of time (usually 6-7 years), and gradually diminishes to zero. The original payment to the advisor’s firm by the fund company is typically 5% for an equity fund. | Similar to the deferred sales charge structure, but with a shorter timeframe for the charge to diminish to zero (typically 1-3 years). The amount paid to the advisor’s firm is generally lower, usually in the 1-3% range. |

Fee based

Another way mutual funds can be sold is through a fee-based structure. Fee-based funds are sold with no sales charge and no redemption fee, but the investor and his or her advisor negotiate an ongoing fee expressed as a percentage of assets that the investor pays to the advisor for the services provided. Fee-based funds are only available to investors through a fee-based account with a full-service investment dealer.

Bottom line on fees

All investments have fees, and it’s important to understand how they can impact your returns. Your advisor is in the best position to guide you on the right investments, at the right cost, to ensure you get the most out of investing within your tolerance for risk.

For more information, please contact your advisor.

For definitions of technical terms in this piece, please visit iaclarington.com/glossary and speak with your investment advisor.

The information provided should not be acted upon without obtaining legal, tax, and investment advice from a licensed professional. Commissions, trailing commissions, management fees, brokerage fees and expenses all may be associated with mutual fund investments, including investments in exchange-traded series of mutual funds. The information presented herein may not encompass all risks associated with mutual funds. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The iA Clarington Funds are managed by IA Clarington Investments Inc. iA Clarington and the iA Clarington logo, iA Wealth and the iA Wealth logo, and iA Global Asset Management and the iA Global Asset Management logo are trademarks of Industrial Alliance Insurance and Financial Services Inc. and are used under license.