Registered Education Savings Plans (RESPs) are a great way to save for your children’s post-secondary studies. They offer a variety of benefits – including government grants and tax deferral – that can help you achieve your saving goals more quickly.

1. Open an RESP and start contributing

Your advisor can help you open an RESP, where your contributions can grow tax free. For one-child families, an individual RESP is the way to go. If you have more than one child or plan to have more, a family RESP can offer additional flexibility.

RESPs have no annual contribution limit, but there is a lifetime limit of $50,000 per child. Family members and friends, such as grandparents or godparents, can help you contribute to an RESP. Even the future student can chip in.

2. Apply for government grants to boost RESP savings

The Canada Education Savings Grant (CESG) adds an amount equal to 20% of your contributions, up to an annual limit of $500 and a lifetime limit of $7,200 per child.

Families with modest incomes can receive additional CESGs on their annual contributions to help them reach the $7,200 lifetime limit. They may also qualify for a Canada Learning Bond of up to $2,000 per child.

British Columbia, Quebec and Saskatchewan offer education savings grants in addition to the federal program. Your financial advisor can tell you which grants your family is eligible to receive and help you apply.

3. Watch your RESP grow

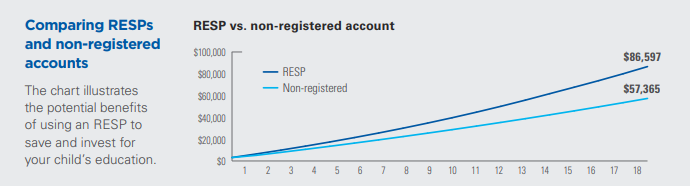

One big advantage of the RESP is that the savings and grants can grow tax free. The growth will depend, in part, on how much you contribute and how much you can receive in government grants.

It will also depend on the investments you choose. Since positive returns are not usually guaranteed, it’s important to select investments that are suited to your circumstances and goals.

Hypothetical example, for illustrative purposes only. Non-registered investment account based on a $2,500 annual contribution for 18 years, with a compound annual return of 5% taxed at 50%. RESP based on a $3,000 initial investment ($2,500 personal and $500 CESG), a $2,500 annual contribution and a $500 CESG contribution, with a compound annual return of 5% and growth that is not taxed.

What happens when RESP money is withdrawn?

Once your child is registered at an approved postsecondary institution, you can start making withdrawals from your RESP account. The contribution portion of the RESP is tax free and there is no restriction on how these funds can be used. The CESG and accumulated earnings on all contributions are paid to the beneficiary as Educational Assistance Payments (EAPs). These funds must be used for education expenses and are considered taxable income for the beneficiary. But since your child is likely in a low tax bracket, any tax should be minimal.

What kind of investments should I buy for my RESP?

Saving for education is different than saving for retirement because you will likely be using the money much sooner. That means you may want your investments to be more conservative, especially in the final years.

iA Clarington offers a wide range of investment funds that are actively managed by skilled and experienced professionals. Your financial advisor can help you select the iA Clarington investments that are best for education savings and right for your family. iA Clarington can also administer your RESP, receiving and investing all contributions and government grants, and managing withdrawals when the time comes.

What happens to the RESP if my child doesn’t enroll in a post-secondary program?

If your child chooses not to pursue post-secondary education, then generally:

- Your contributions are returned to you tax free

- Investment earnings are returned, but you will have to pay tax on them

For individual RESPs, the CESG must be repaid unless there is another eligible beneficiary. This is the advantage of family RESPs: the grant money can be transferred to other students in the plan as long as no one receives CESG money exceeding $7,200.

Note that an RESP must be closed by December 31st of the 35th year the plan has been active.

Speak with your advisor to get started with an RESP from iA Clarington.

For definitions of technical terms in this piece, please visit iaclarington.com/glossary and speak with your investment advisor.

The information provided should not be acted upon without obtaining legal, tax, and investment advice from a licensed professional. Commissions, trailing commissions, management fees, brokerage fees and expenses all may be associated with mutual fund investments, including investments in exchange-traded series of mutual funds. The information presented herein may not encompass all risks associated with mutual funds. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. The iA Clarington Funds are managed by IA Clarington Investments Inc. iA Clarington and the iA Clarington logo, iA Wealth and the iA Wealth logo, and iA Global Asset Management and the iA Global Asset Management logo are trademarks of Industrial Alliance Insurance and Financial Services Inc. and are used under license. iA Global Asset Management Inc. (iAGAM) is a subsidiary of Industrial Alliance Investment Management Inc. (iAIM).