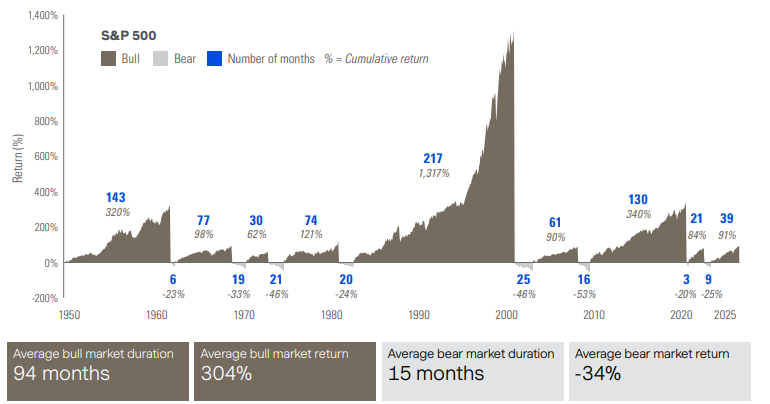

No one enjoys a bear market – usually defined as a market decline of 20% from recent highs. But looking back through the history of the U.S. stock market, it’s clear that on average, bull markets – usually defined as a sustained period of rising markets – last longer and more than make up for losses incurred during bear markets.

This is one more reason to focus on the long term and stay invested – even when the markets are going through a rough patch.

Bull and bear markets in the U.S. since 1950

Source: Bloomberg, as at December 31, 2025.

Cumulative return – The total amount an investment has gained or lost over a specified period of time.

For definitions of technical terms in this piece, please visit iaclarington.com/glossary and speak with your investment advisor.

The information provided should not be acted upon without obtaining legal, tax, and investment advice from a licensed professional. Commissions, trailing commissions, management fees, brokerage fees and expenses all may be associated with mutual fund investments, including investments in exchange-traded series of mutual funds. The information presented herein may not encompass all risks associated with mutual funds. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

The iA Clarington Funds are managed by IA Clarington Investments Inc. iA Clarington and the iA Clarington logo, iA Wealth and the iA Wealth logo, and iA Global Asset Management and the iA Global Asset Management logo are trademarks of Industrial Alliance Insurance and Financial Services Inc. and are used under license. iA Global Asset Management Inc. (iAGAM) is a subsidiary of Industrial Alliance Investment Management Inc. (iAIM).