Dan Bastasic

MBA, CFA

Senior Vice-President, Investments & Portfolio Manager

iA Global Asset Management Inc.

Dan has over 20 years of investment experience and is the lead portfolio manager for the IA Clarington Strategic Funds and IA Clarington Tactical Income Class. He specializes in equity income, high-yield corporate bonds and investment grade corporate bonds.

Dan is a CFA charterholder and a member of the CFA Society Toronto. He holds a Bachelor of Commerce degree in Finance and an MBA from the University of Windsor.

"My funds don’t reflect the index, and for good reason. To maximize returns, you have to minimize risk and try to preserve the client’s original investment. To do that, you can’t just follow the index."

Dan's philosophy

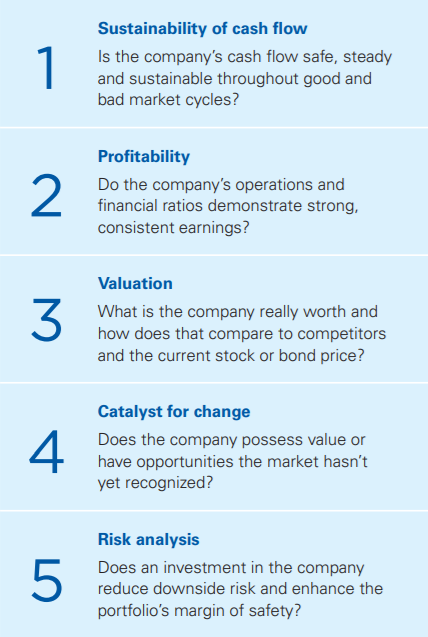

Dan aims to provide investors with stable income options. He uses a value-oriented, bottom-up approach for both equities and fixed income and constantly monitors and fine tunes his portfolios by maintaining a 12-month strategic outlook on the markets.

Key features of Dan’s approach:

- Focus on absolute returns

- High-conviction, value-based security selection

- Fundamental-driven valuation and quantitative analysis

- Macro analysis of systemic risks and opportunities

- Risk management through diversification and currency management

Funds managed

- IA Clarington Global Balanced Plus Portfolio

- IA Clarington Strategic Corporate Bond Fund

- IA Clarington Strategic Equity Income Fund

- IA Clarington Strategic Equity Income Class

- IA Clarington Strategic Income Fund

- IA Clarington Strategic Equity Income GIF

- IA Clarington Strategic Income GIF

- IA Clarington Tactical Income Class

Market insights

-

Weekly Macro & Market Update

Videos | Sep. 19, 2025

-

2025 Mid-Year Review

Reports | Jul. 9, 2025

-

Introducing the IA Clarington Multi-Strategy Alternative Pool

Videos | Mar. 5, 2025

-

De-risk or Re-Risk? Active Strategies for 2025

CE Credits | Webcasts | Feb. 19, 2025

-

Opportunities in Global Dividend Stocks

Videos | Jan. 9, 2025